TUAC response to the OECD urging governments to respond to the ongoing slowdown

23 May 2019

OECD urges governments to respond to the ongoing slowdown

The Economic Outlook that was released at the OECD Forum this week once again confirms that growth in the global economy has gone down significantly and is set to remain weak. For the OECD, trade restrictions are a key source of the slowing economy. Trade growth has plunged and corporate investment has weakened as well. Manufacturing is weak. The OECD also warns not to underestimate the many downside risks and spillovers. The dismal situation in manufacturing may spill over into the services sector A sharp slowdown in China would have collateral impact on global trade and growth worldwide. With private debt, in particular non-financial corporate debt, at record levels across the world, especially in China, the slowdown could even cause another financial crisis. Worldwide, the non-financial corporate sector has built up some US$13 trillion of sub-par debt.

Urgent action

The OECD calls for “urgent government action to reinvigorate growth”. It strongly urges governments to use all the policy tools at their disposal :

- by reigniting multilateral trade negotiations; and

- by undertaking fiscal stimulus, notably by using public spending to boost much-needed investment, in combination with structural reforms where demand is weak and where public debt is relatively low; and

- the focus should be on preparing for the challenges of tomorrow: skills, physical infrastructure and digital networks.

Germany needs to do better for growth in the Euro area

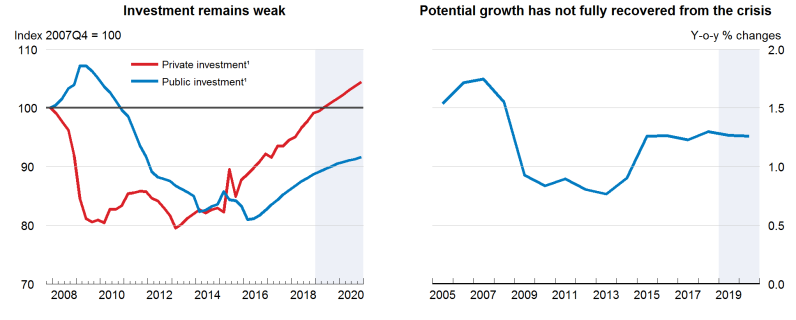

Moreover, a more detailed reading of the Outlook, in particular some of the country chapters, reveals even more interesting views from the OECD: Germany for example is urged to step up public investment ambition, thus delivering faster growth for the euro area (page 140). In the OECD fiscal stimulus scenario, a 0.5% GDP fiscal stimulus in Germany and other euro area surplus countries would strengthen growth in the short run and raise GDP by around 1% in the longer term. And a graph reproduced below illustrates how austerity in the Euro Area has squeezed public investment to the tune of a cut of 10% in its share of GDP since the financial crisis.

TUAC Comments

There are thus several messages and insights from the Economic Outlook that can be supported, such as: (i) the call upon policy-makers not to accept the economic slowdown as the “new normal” but to be responsive to it, (ii) the view that fiscal policy should take into account and make good use of the fact that fiscal space is enhanced as interest rates in many economies are below nominal growth rates, (iii) insistence on the fact that domestic demand is for the moment keeping the economy going, thus implicitly referring to the role wages should play in securing a robust recovery.

At the same time, policy needs to go further. Fiscal stimulus and recovery of public investment needs to be broader if it is to be effective. To secure a strong and sustained recovery that relies on itself and feeds on its own strength, instead of depending excessively on what happens at the other end of the world (China), policy needs to close the inequality gap. Supporting collective bargaining instead of policy to weaken trade unions is indispensable here. Finally, the OECD would do well to warn its members not to waste fiscal policy efforts on regressive tax cuts that benefit the wealthy.

Focus on the impact of productivity

A special chapter in the Economic Outlook assesses digital technologies, which are increasingly present in our lives, but have not yet fulfilled their potential to enhance living standards for all. It notes that government policies will have a key role to play to ensure that citizens make the most of opportunities afforded by new technologies.

The Economic Outlook focus on the need to lift labour productivity is much welcome. However the report takes a narrow stance on the issue by relying on business dynamism measures and enhancing workers’ skills.

We agree that access to skills is important, but lifting labour productivity will require going beyond skills: investing in infrastructure and in emerging and growing sectors for a greener economy, investing in social protection and in active labour market instruments, including career guidance.

Digital diffusion can halt and indeed reverse the trend toward productivity slowdown. But the benefits of digitalisation need to be better shared and better measured. How can we put a price tag on data with the current accounting and reporting rules?

The OECD should also be concerned about the market concentration of the digital sector, the many opportunities for regulatory arbitrage, on tax, on labour rights and the rise of non-standard employment. The recent Employment Outlook does go in that direction where it acknowledges that “policy makers should aim in the long term to ensure a level tax and regulatory playing field between competing activities”. The Employment Outlook is also stressing the importance of employment status as a gateway to worker protection, thus calling upon governments to tackle the misclassification of dependent workers as self-employed by stepping up labour law regulation and enforcement. The Economic Outlook’s special chapter however misses the opportunity to refer to these messages.