OECD Interim Forecast shows recovery is far from inclusive

13 March 2018

In its Interim Forecast released on the 13th of March, the OECD has slightly revised upwards its growth projections for 2018 and 2019 compared with the November 2017 OECD Outlook. Global GDP growth is now expected to reach almost 4% in the next two years.

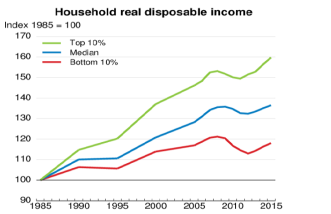

However, the Forecast also illustrates that the wounds inflicted by the Great Recession are far from healed as the economic recovery has been uneven and has mainly benefited the richest. Whereas the real disposable income of the 10% top households has increased significantly and is exceeding its pre-crisis level, this is not the case for the median and bottom 10% households. Incomes of the bottom 10% are still below the level they were before the crisis (see graph below).

Main takeaways

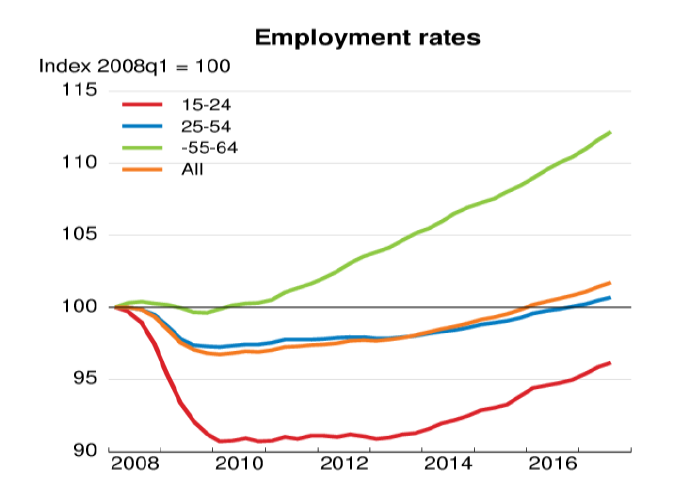

- The scar of youth unemployment has not healed. The recovery has bypassed younger people. Employment rates of 15 to 24 year old still have to recover substantially in order to reach the pre-crisis level (see graph below).

- The OECD takes an ambiguous position on the US tax reform. The Forecast is careful not to draw explicit conclusions, yet estimates are telling. Corporations are the main beneficiary of the US Tax Cuts and Jobs Act. From the 2% of GDP total fiscal easing over 2018 and 2019, three quarters (1.3% of GDP) are expected to go to corporate tax cuts. Even if the OECD estimates that the entire fiscal stimulus would lift US GDP by 0.50 to 0.75 percentage points, it also warns that tax reductions for the richest households would go more into savings than into increased expenditure. In the end, the US tax cut plan is likely to mostly benefit rich households and shareholders, while delivering relatively small gains in output and jobs compared to the size of the stimulus. In the same vein, the OECD also expresses concerns about what it calls “excessively” pro-cyclical fiscal policy.

- Counting on stronger wages to get inflation back up. The Interim Forecast states that a “modest increase in inflation from subdued levels would be welcome” and that this depends on wage growth picking up. Here, the OECD again observes that wage dynamics remain weak despite falling unemployment rates. The OECD however refrains from drawing the conclusion that past structural reforms have increased labour market insecurity and have undermined the bargaining position of labour.