A message for the world’s leaders at Davos: Mind deflation, (re)build stronger collective bargaining systems

20 January 2016

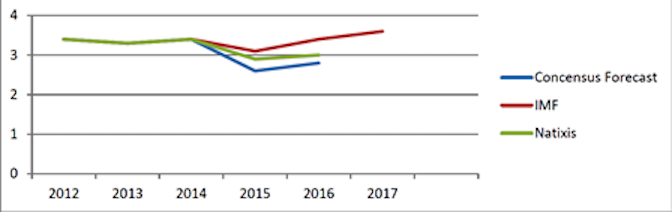

The IMF released its latest World Economic Outlook (WEO) Update yesterday pointing to persistently weak growth and another downward revision of its projected growth rates for 2016 and 2017 by 0.2 percentage points each year. Despite this, the IMF’s growth trajectory still sees the world economy recovering slightly from the weakness it experienced last year (see Graph 1).

Graph 1: Outlook for world economic growth. Source: IMF World Economic Outlook Update (http://www.imf.org/external/pubs/ft/weo/2015/update/02/pdf/0715.pdf) and Natixis Flash Economie, 6/1/2016, nr. 20, (http://cib.natixis.com/flushdoc.aspx?id=88827)

From past experience, however, we know that forecasters tend to underestimate economic downturns while overestimating the recovery. Given the vast list of negative shocks and developments that are or will be hitting the economy, this time may NOT be different:

- In the US, the labour market is not in brilliant shape (unemployment numbers are low but the participation rate has fallen, there is no or little sign of accelerating wage dynamics either). At the same time, its economy is in its sixth year of economic expansion, a timing that is usually linked to the turning of the business cycle. The Fed’s decision to start raising interest rates in December 2015 would point in the same direction of a weakening business cycle (or rather one that is de facto being weakened because of monetary policy slowing it down).

- In the UK, growth over the recent years has been driven by household expenditure, which in turn was based on the reappearance of a certain real estate bubble. At this moment, however, household demand for new mortgages is decelerating. If the renewed real estate bubble would come to a standstill or go into reverse, UK growth performance would suffer.

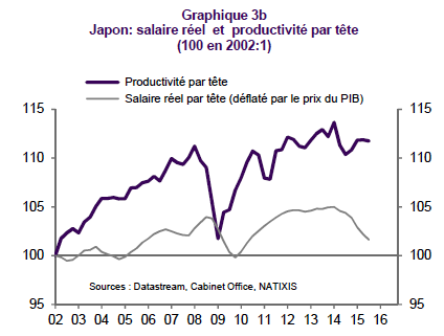

- In Japan, while ‘Abenomics’ is injecting short bursts of demand and growth into the economy, it is failing to kick start the process by which growth becomes self-sustained as real wages in Japan keep lagging behind productivity (see Graph 2). Even if the government seems to have rediscovered the value of coordinated collective bargaining in steering the economy away from deflation and in redistributing high but idle corporate cash reserves back to workers, too many jobs in Japan remain precarious, part time and hence underpaid.

Graph 2: Evolution of real wages and productivity per head in Japan since 2002. Source: Natixis, Flash Economie, 06/01/2016

- Meanwhile, the Euro area keeps struggling with its own contradictions: The policy choice that Euro area policy makers made on replacing the missing instrument of currency devaluation by an internal devaluation of wages keeps feeding into disinflation. Combine this drive for downwards wage flexibility with other factors such as headline inflation already at zero due to falling oil prices, inflation expectations back on a downwards trend, record high levels of (public but also private!) debt loads, piles of non-performing loans in several parts of the euro area banking system and, last but not least, a Stability Pact or Fiscal Compact that keeps pushing several member states (notably Spain, France, Italy) into fiscal austerity, it becomes clear that the world economy cannot count on the Euro area economy to drive world economic growth. The opposite is the case: With a current account surplus approaching a level of 3.7% GDP, the Euro Area is subtracting even more demand and growth from the world economy than before (and more demand than China or Japan, recording a current account surplus of 3% and 3.3% respectively).

- In the emerging part of the world, China is caught in the same trap of capitalist exuberance, over-indebtedness and over-investment that other economies have come to know so very well. As can be seen from the graphs below, since 2008, corporate (non-financial) sector debt has gone into overdrive, increasing from around 100% to almost 150% of GDP.